Biweekly mortgage calculator with extra payments and lump sum

The example presumes your mortgage rate remains at 3 APR. Make Lump Sum Loan Payments.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Recurring extra payments add up to reduce your principal balance.

. This is the best option if you plan on using the calculator many times over the. We also generate graphs summaries of balances payments and interest over the life of your mortgage. Here are different payment methods you can try.

This wont change your monthly payment amount. Biweekly Mortgage Calculator with Extra Payments. In a year you might receive lump sum payments in the form of an annual work bonus or a windfall from a business venture.

Pay off your mortgage early by adding extra to your monthly payments. Balloon payments are often used in commercial mortgages. With biweekly mortgage payments you make a payment toward your.

You may also enter extra lump sum and pre-payment amounts. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Mortgage Calculator with Lump Sums.

You may also enter extra lump sum and pre-payment amounts. Create an amortization schedule with extra payments or lump sum payment on any date. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

This is commonly known as a biweekly payment plan. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. These require a large lump sum mount by the end of the term to completely pay off the lender.

NerdWallets early mortgage payoff calculator figures out how much more to pay. Simply add the scheduled payment B10 and the extra payment C10 for the current period. Make a 13th Loan Payment Each Year.

Scheduled payment minus interest B10-F10 or the remaining balance G9. This is the best option if you are in a rush andor only plan on using the calculator today. Extra Payments In The Middle of The Loan Term.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Before the end of your term.

If the schedule payment for a given period is greater than zero return a smaller of the two values. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. April 18 2022 at 1202 am.

These include making lump sum payments or shifting to a biweekly payment schedule while making additional payments. Paying a lump sum toward your principal helps reduce it faster therefore decreasing your future interest charges. For example if you are 35 years into a 30-year home loan you would set the loan term to 265.

You can make lump-sum payments. This will result in significant savings on a mortgage. Loan Payoff Calculator wirregular payments.

Well compare a regular mortgage payment with a lump sum 13th payment done once a year. Mortgage loan basics Basic concepts and legal regulation. If paying your mortgage loan off sooner is your goal perhaps a lump-sum payment is the right option to pursue.

Check your mortgage contract for the specific amount. You can do this by making a one-time payment towards the principal balance. IFERRORB10C10 Principal E10.

Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. Balloon payments are often found in loans with short terms.

Besides making extra payments you also have the option to send a lump-sump extra payment by the end of the year. Make sure one thing. You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc.

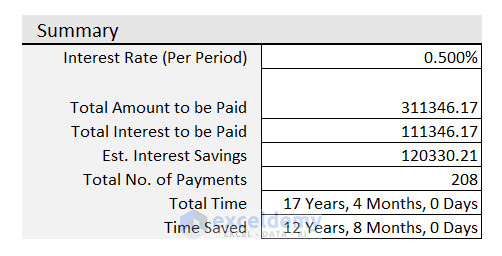

But if you have large funds you can use it to decrease a considerable portion of your loan. Viewing Your Results Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made. Biweekly Payments save interest.

You may only be able to put a limited amount of money toward your mortgage. You can use your current lender to switch to biweekly payments or create a schedule yourself. Whatever the frequency your future self will thank you.

At certain times during your term. Switching to a more frequent mode of payment such as biweekly payments has the effect of a borrower making an extra annual payment. Fortnightly payments follow the 52-week calendar year instead of the 12-month.

The following is a list of different types of loans and how they utilize balloon payments. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Is approaching 400000 and interest rates are hovering around 3.

At the end of your term. Make sure you look for mortgage scams and check with your lender to make sure it supports biweekly payments and credits you appropriately. Please use the Ultimate Mortgage Calculator.

We also generate graphs summaries of balances payments and interest over the life of your mortgage. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. This mortgage calculator gives a detailed breakdown of your mortgage and calculates payment schedules over your full amortization.

A prepayment is a lump sum payment made in addition to regular mortgage installments. Here are the advantages of making extra mortgage payments. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly.

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. You can make a lump-sum payment on top of your regular mortgage payments. Mortgage Amount or current balance.

A biweekly mortgage payment schedule makes a payment on your mortgage every two weeks instead of once a month. Mortgage calculator with extra payments and lump sum Excel Template Excel amortization schedule with irregular payments Free Template Mortgage payoff calculator with extra principal payment Excel. There are two primary strategies for making extra payments on your mortgage.

Besides extra monthly payments there are other payment strategies you can adapt to reduce your mortgage term. Total Payment D10. Make more frequent payments.

Make a lump-sum payment. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. You can time this large payment with your work bonus or even your tax return.

Making Lump Sum Payments or Prepayments. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. Lump-Sum Payments What if you experience a windfall and come into some extra funds.

Your bi-weekly or extra payments if you make are applied to your account with immediate effect. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Calculate how much interest youll save.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Bi Weekly Mortgage Amortization Calculator With Extra Payments

Biweekly Mortgage Calculator How Much Will You Save

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments Payment Schedule

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator How Much Will You Save

Mortgage With Extra Payments Calculator